Are you familiar with the W-9 Form? It’s an essential document used by individuals and businesses to collect information from vendors and independent contractors. Whether you’re an employee or a freelancer, understanding the purpose and importance of this form is crucial. Today, we’ll be delving into the ins and outs of the W-9 Form in order to provide you with a comprehensive overview.

What is the W-9 Form?

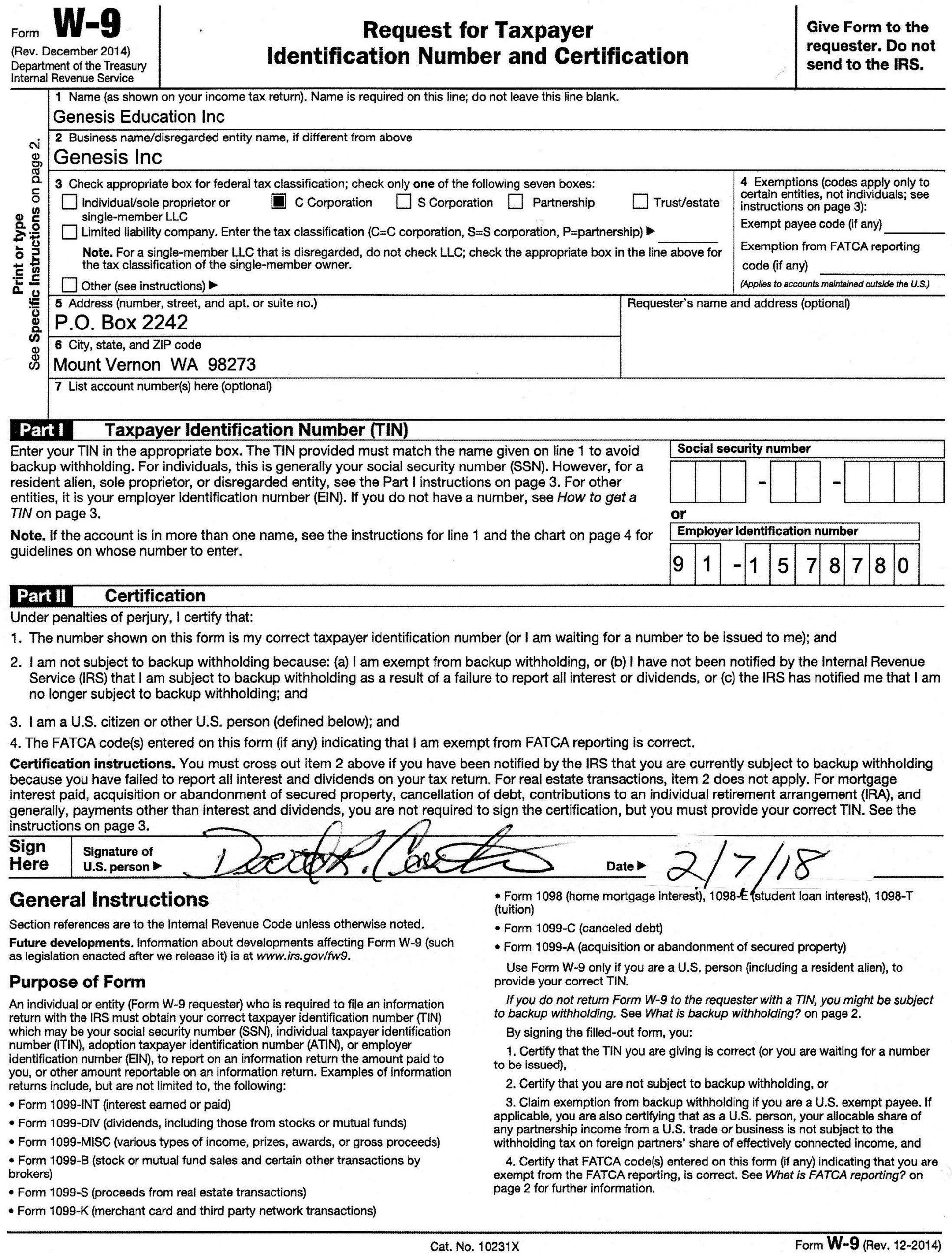

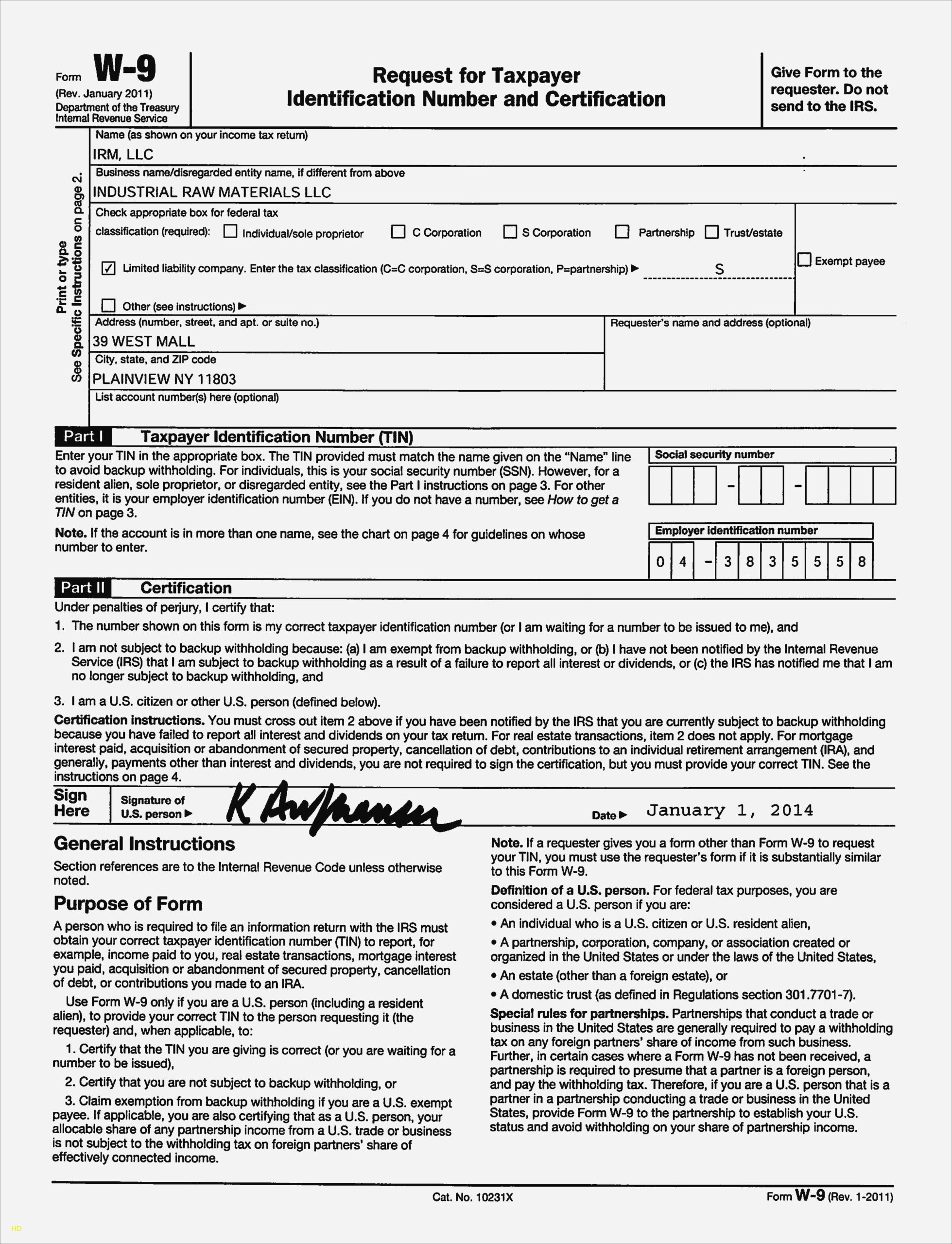

The W-9 Form, officially known as the “Request for Taxpayer Identification Number and Certification,” is a document issued by the Internal Revenue Service (IRS) in the United States. It is used to request the taxpayer identification number (TIN) of individuals or entities for tax purposes. Vendors and independent contractors often have to complete this form when providing their services to businesses.

The W-9 Form, officially known as the “Request for Taxpayer Identification Number and Certification,” is a document issued by the Internal Revenue Service (IRS) in the United States. It is used to request the taxpayer identification number (TIN) of individuals or entities for tax purposes. Vendors and independent contractors often have to complete this form when providing their services to businesses.

Why Use a W-9 Form?

The main purpose of the W-9 Form is to collect the necessary information to accurately report income paid to vendors or independent contractors. The TIN provided on the form is used by the payer to report payments to the IRS, ensuring compliance with tax laws. The form also certifies that the TIN provided is correct and that the individual or entity is not subject to backup withholding.

The main purpose of the W-9 Form is to collect the necessary information to accurately report income paid to vendors or independent contractors. The TIN provided on the form is used by the payer to report payments to the IRS, ensuring compliance with tax laws. The form also certifies that the TIN provided is correct and that the individual or entity is not subject to backup withholding.

How to Fill Out a W-9 Form

Filling out a W-9 Form is relatively straightforward. First, you’ll need to provide your name, business name (if applicable), and TIN. The most common TIN used is the Social Security Number (SSN) for individuals or the Employer Identification Number (EIN) for businesses. Additionally, you may need to indicate if you’re exempt from backup withholding.

Filling out a W-9 Form is relatively straightforward. First, you’ll need to provide your name, business name (if applicable), and TIN. The most common TIN used is the Social Security Number (SSN) for individuals or the Employer Identification Number (EIN) for businesses. Additionally, you may need to indicate if you’re exempt from backup withholding.

Once you’ve completed the necessary fields, you’ll need to sign and date the form. It’s important to ensure that all the information provided is accurate and up to date. Depending on the circumstances, you may need to provide a new W-9 Form if any of the information changes.

Importance of a W-9 Form for Businesses

For businesses, obtaining a completed W-9 Form from vendors and independent contractors is vital. It helps in several ways:

For businesses, obtaining a completed W-9 Form from vendors and independent contractors is vital. It helps in several ways:

- Accurate Reporting: By collecting the correct TIN and other relevant information, businesses can ensure accurate reporting of income paid to the IRS.

- Backup Withholding: The W-9 Form helps determine whether backup withholding applies to the payee. Backup withholding is when the payer withholds a percentage of payment to ensure that taxes are paid.

- Avoiding Penalties: Businesses could face penalties if they fail to report income or provide incorrect information to the IRS. Collecting a completed and accurate W-9 Form significantly reduces these risks.

Conclusion

The W-9 Form serves as a critical tool for businesses to accurately report income paid to vendors and independent contractors. By complying with tax regulations and obtaining completed W-9 Forms, businesses can ensure smooth financial operations and avoid penalties.

The W-9 Form serves as a critical tool for businesses to accurately report income paid to vendors and independent contractors. By complying with tax regulations and obtaining completed W-9 Forms, businesses can ensure smooth financial operations and avoid penalties.

So, whether you’re an individual providing services as a freelancer or a business hiring independent contractors, understanding the importance of the W-9 Form is crucial. Remember to keep this form on your radar and always ensure accurate and up-to-date information.